In-depth market analysis highlights clear gaps and untapped opportunities in terms of cost-effectiveness, flexibility, and user needs. The competitive landscape offers insights into how existing solutions stack up, revealing potential areas where newer, more agile offerings can thrive. Here’s what the market reveals -

Established Self-Storage Companies

• Source - The Tribune India

• Summary - Offer reliable, long-term storage with various unit sizes but are often costly and inflexible.

On-Demand Storage Providers

• Source - Warehousing Express

• Summary - Provide flexibility and convenience but may have limited storage space and higher costs.

Local Movers and Packers

• Source - Leo Packers and Movers

• Summary - Offer storage as an add-on to moving services, which can be less flexible and more expensive.

Real Estate Developers

• Source - Economic Times

• Summary - Integrate storage units into commercial properties, offering convenience but with higher costs and less flexibility.

Data shows the problem—But does the indian market?

Market Overview

SWOT Analysis

To gain a clearer understanding of these dynamics and identify opportunities for improvement, a SWOT analysis will help us evaluate the strengths, weaknesses, opportunities, and threats within the current market landscape. This approach will offer strategic insights that drive the design of more user-focused and cost-effective solutions.

Strengths

Established Infrastructure and Security : Real estate developers and established self-storage companies have strong physical infrastructures, providing customers with large, secure storage spaces. This appeals to users who require long-term for their belongings.

Customer Trust & Brand Recognition : Larger established players, particularly in self-storage, enjoy strong brand recognition. Customers are likely to trust these companies for their consistency and reliability, especially for long-term storage solutions.

Weaknesses

High Costs : Real estate developers and established self-storage companies operate at a higher price point, which alienates cost-sensitive customers. The focus on premium services means they are less accessible to a broader market looking for more affordable options.

Limited Technology Integration : Most established players are slow to adopt newer technologies like real-time tracking and app-based management, making the customer experience less seamless compared to what more flexible or tech-driven solutions could offer.

Threats

Economic Downturns : During economic slowdowns, customers may opt for more affordable solutions or even forego formal storage altogether, relying on informal networks. This would particularly hurt high-cost players like real estate developers and premium storage providers.

Price Sensitivity : As the market grows more competitive, price wars could emerge, especially if larger competitors reduce their prices or adopt more flexible terms to retain market share. This could pressure newer companies to lower their margins or enhance service offerings .

Opportunities

Innovation and Digital Transformation : On-demand storage providers have started to make inroads here but have not fully dominated. This is a market space where leveraging mobile-first platforms, automation, and enhanced user experiences, could stand out significantly.

Affordable and Flexible Solutions : With the high costs and rigidity of the dominant players, there’s a large gap in the market for solutions that provide both affordability and flexibility. This could cater to underserved segments with short-term storage needs.

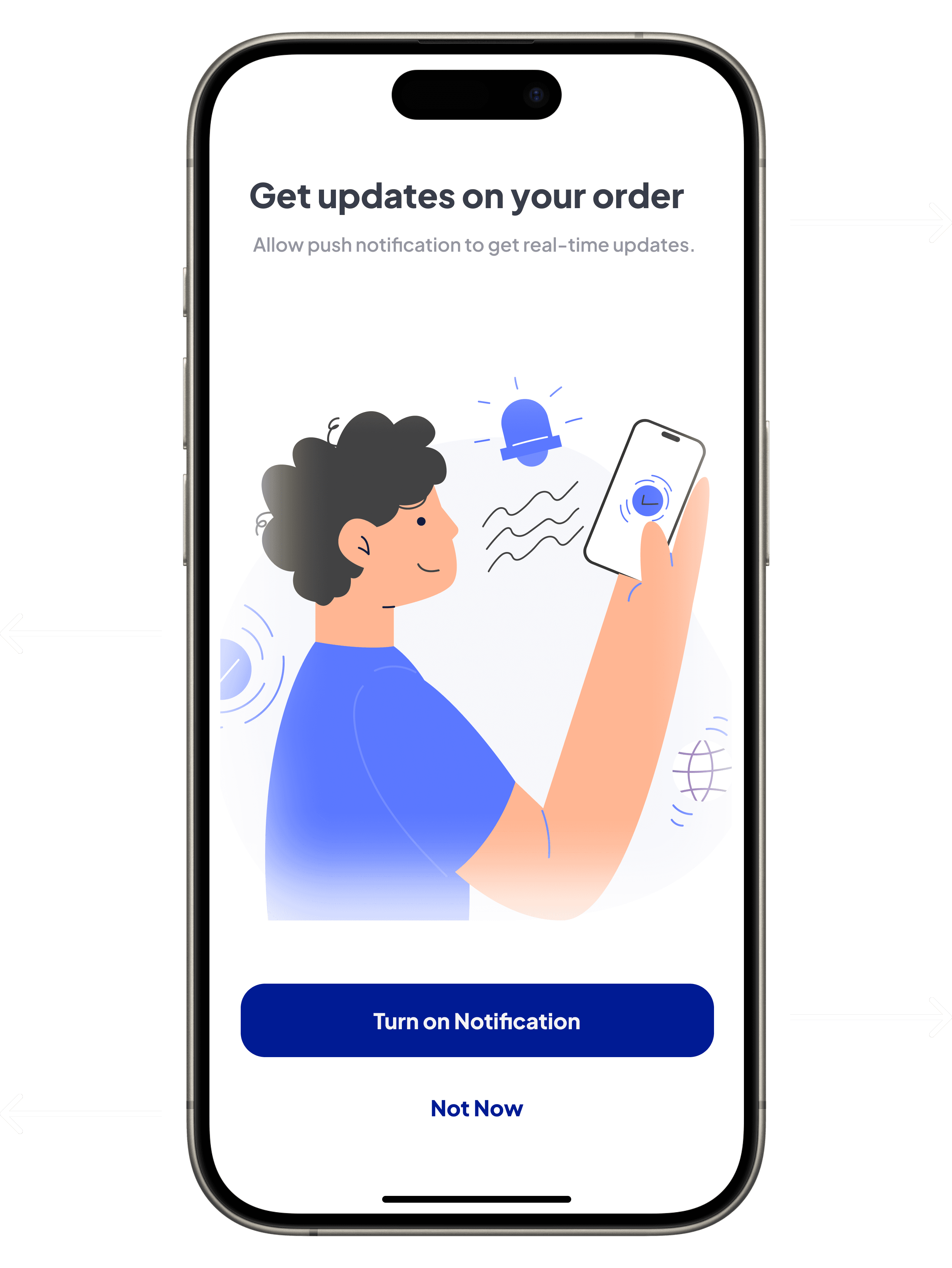

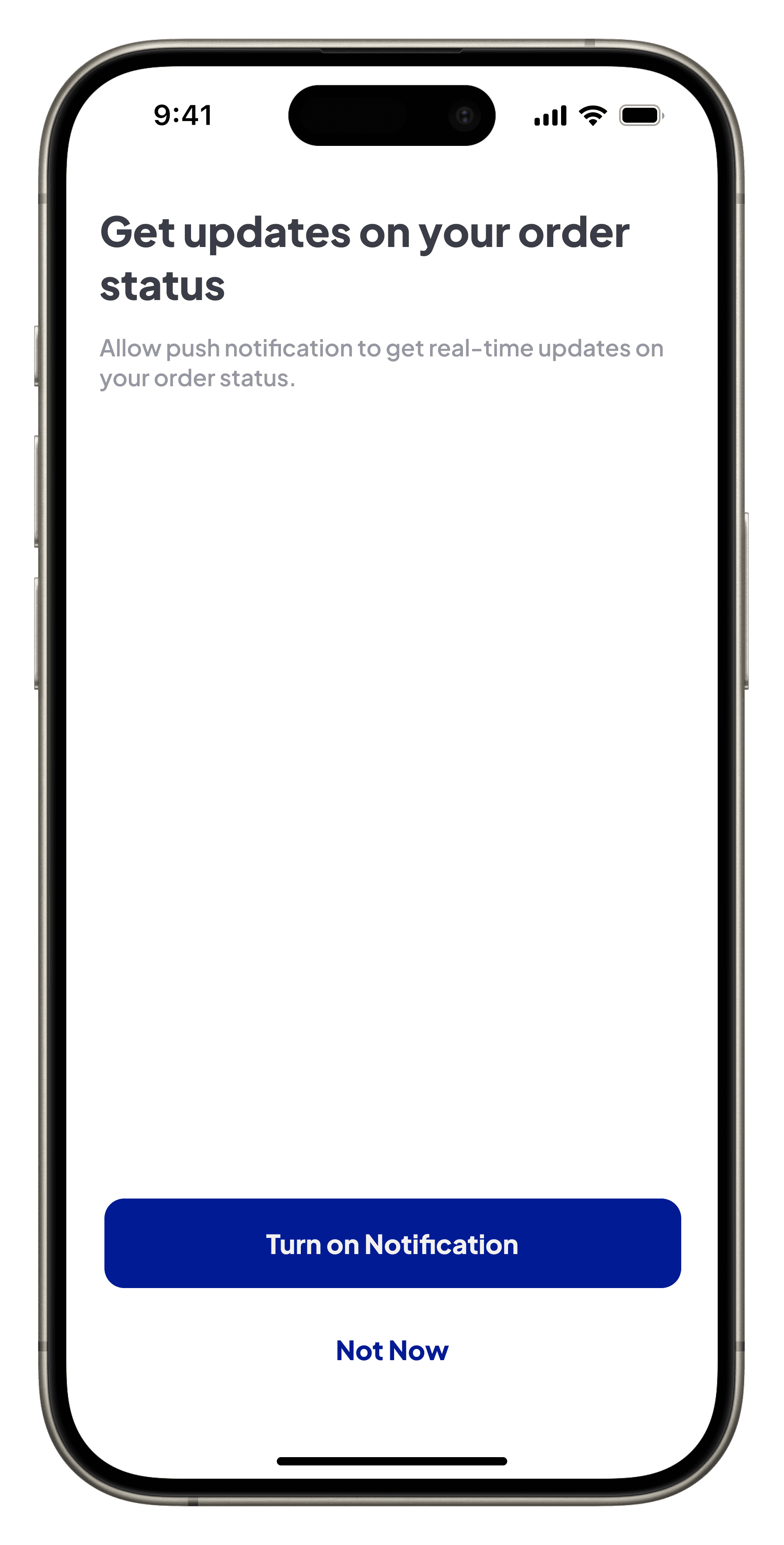

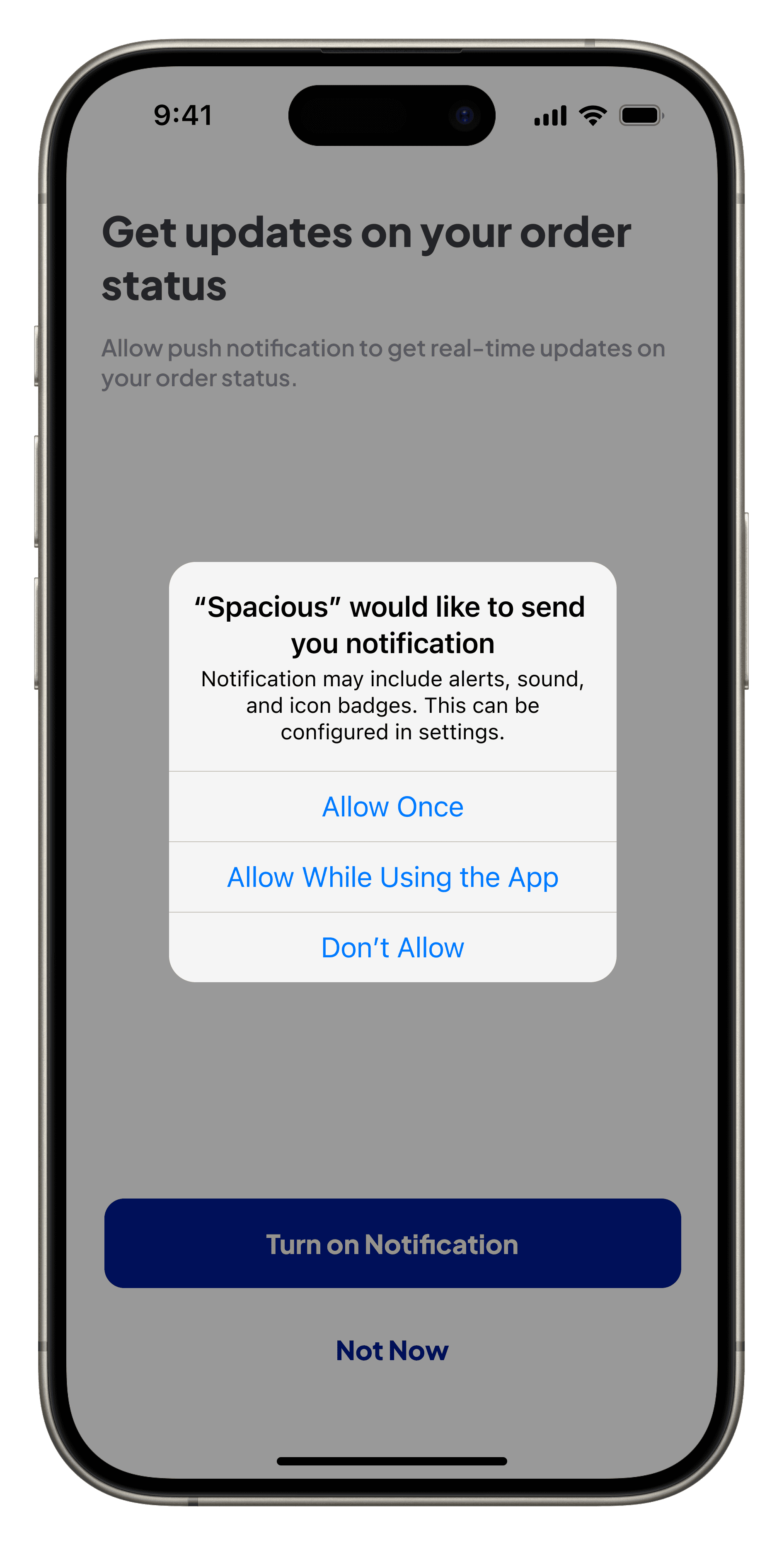

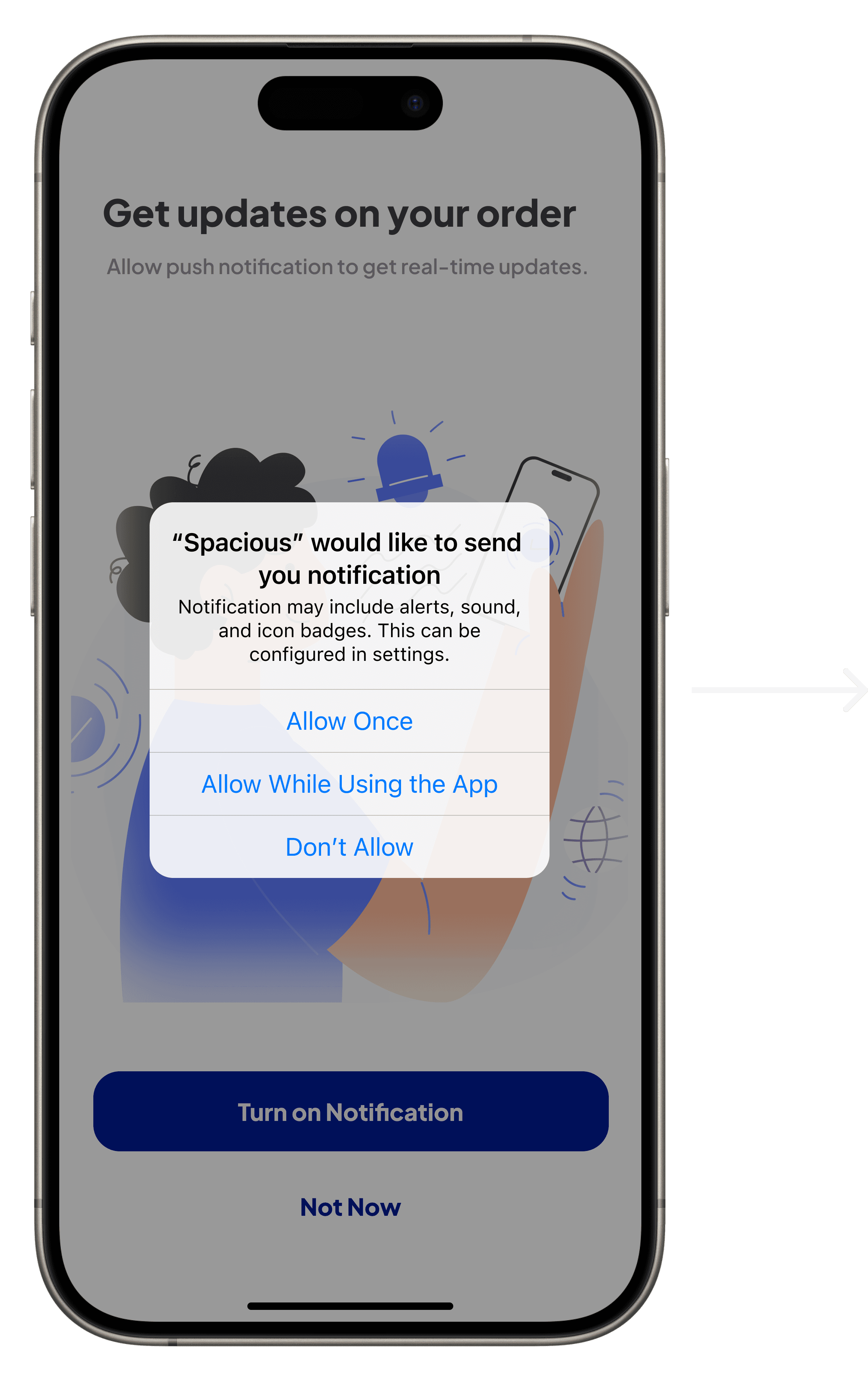

Notification Enablement

The illustration visually reinforces the concept of receiving notifications, making it more engaging.

Secondary call-to-action offers a “Not Now” option, maintaining user control and flexibility.

Primary call-to-action encourages users to turn on notification, strategically placed for easy thumb access.

The revised heading now conveys that notifications cover all app-related updates rather than just order status, and the subtext emphasizes the importance of enabling real-time push notifications.

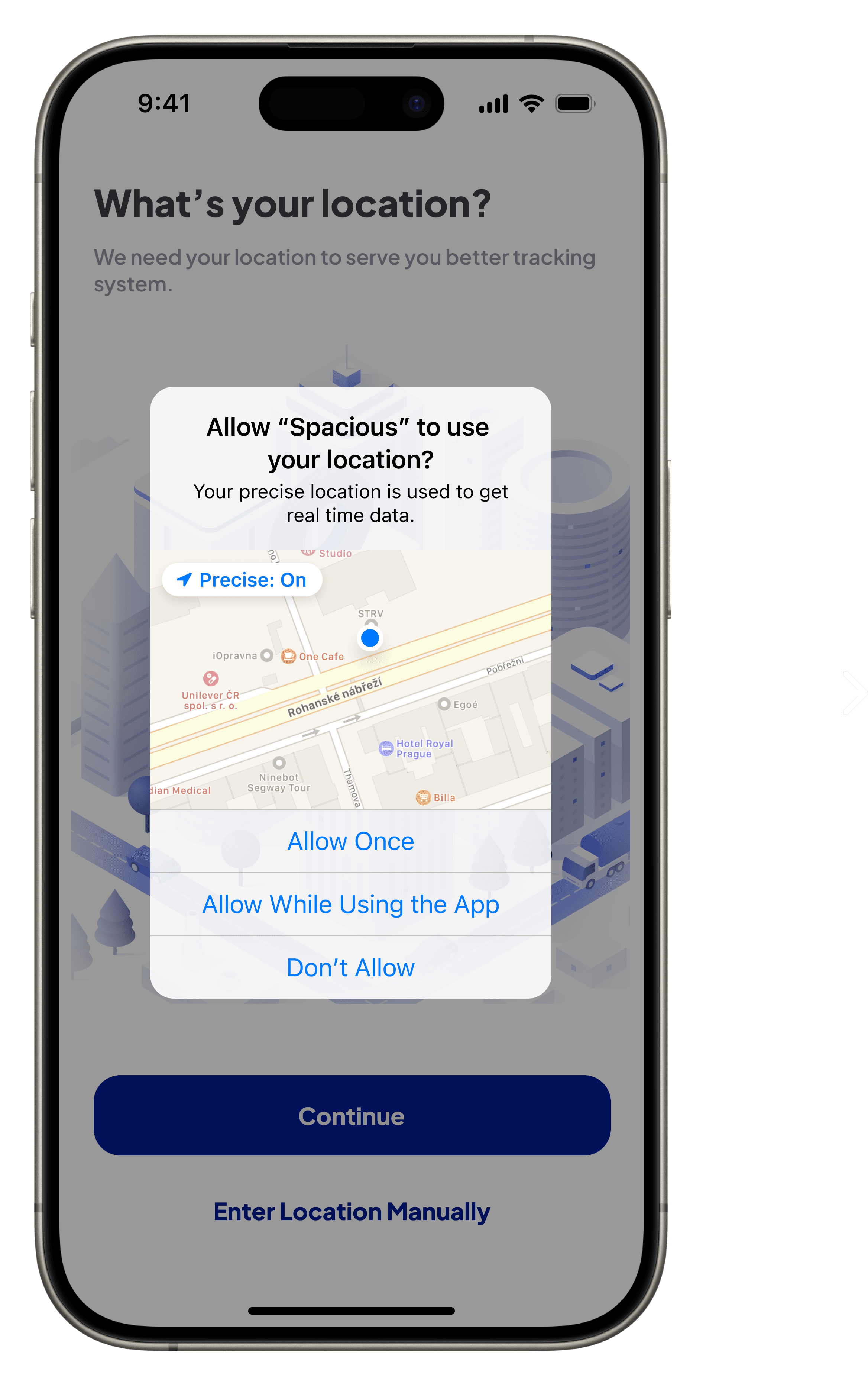

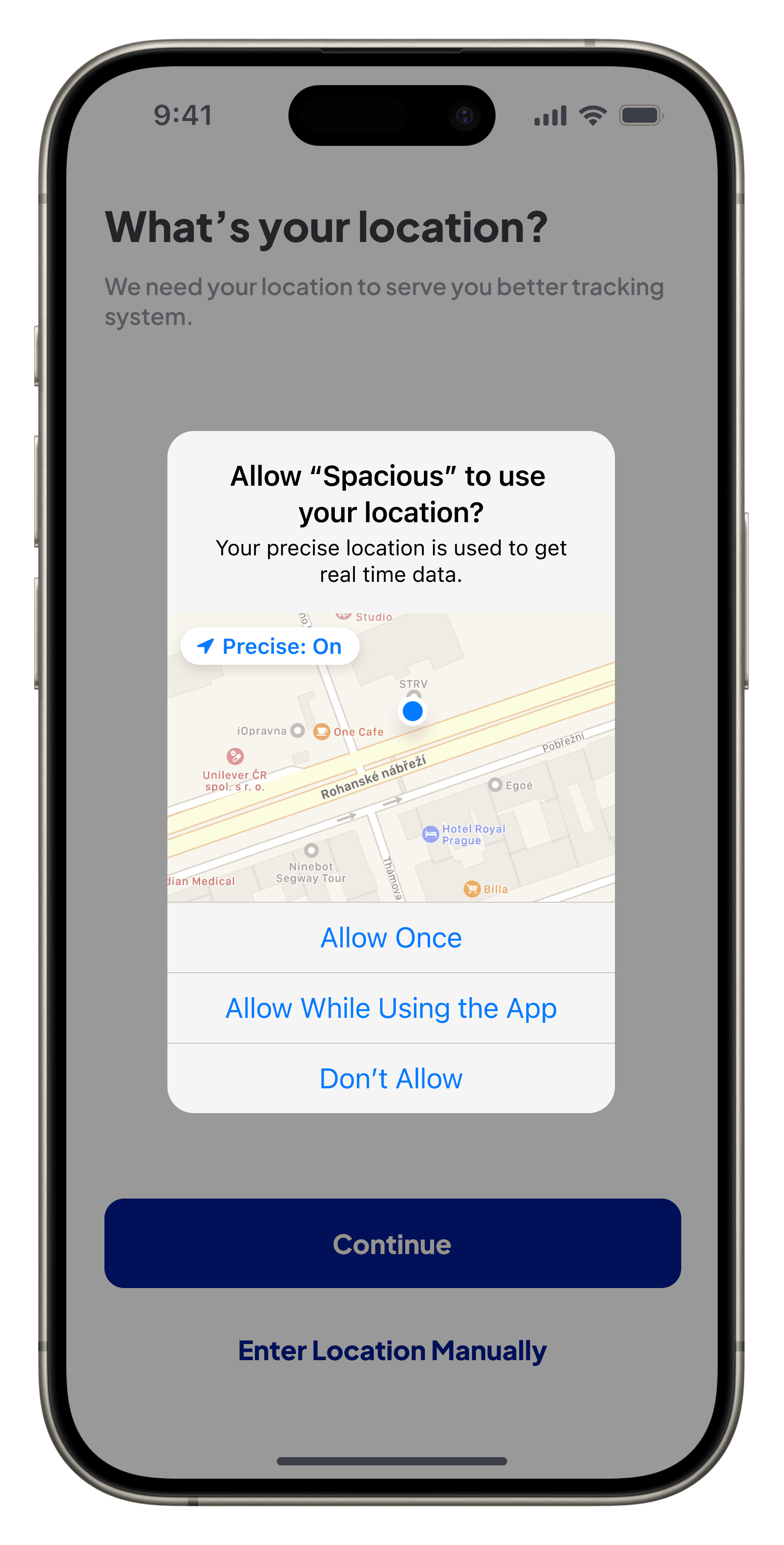

The product will ask for permission, prioritizing user privacy and transparency, ensuring users have control over location sharing.

2nd & Final Iteration

1st Iteration

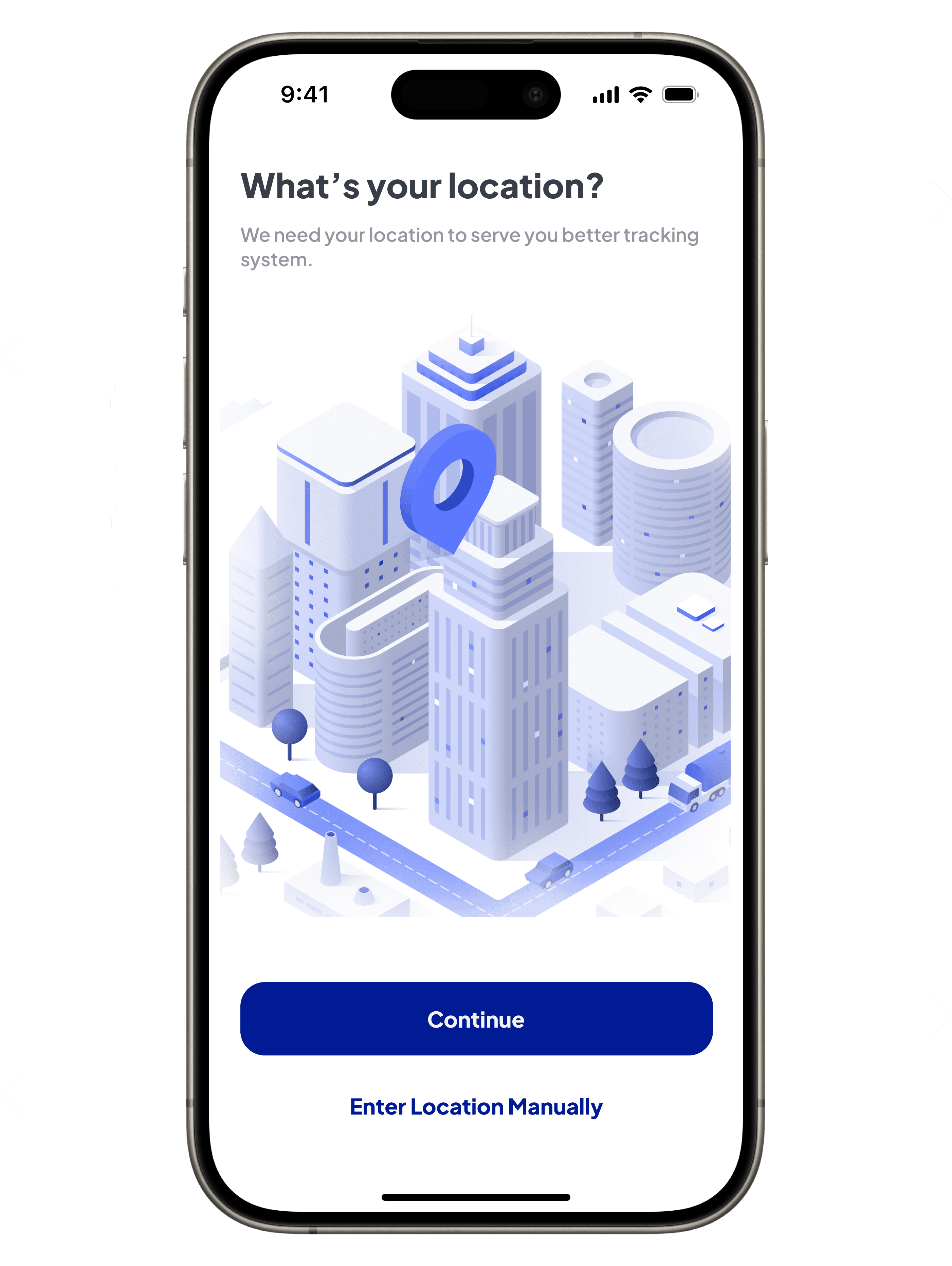

Location Enablement

The central image of an urban area with a location pin reinforces the purpose of sharing location, helping users understand location-based tracking.

Offers a secondary option for users who prefer manual input, ensuring flexibility.

The bold heading prompts users to share their location, while the subtext explains that it’s needed for a better tracking system, enhancing transparency.

The bold blue primary call-to-action encourages users to proceed with automatic location detection.

The product will ask for permission, prioritizing user privacy and transparency, ensuring users have control over location sharing.

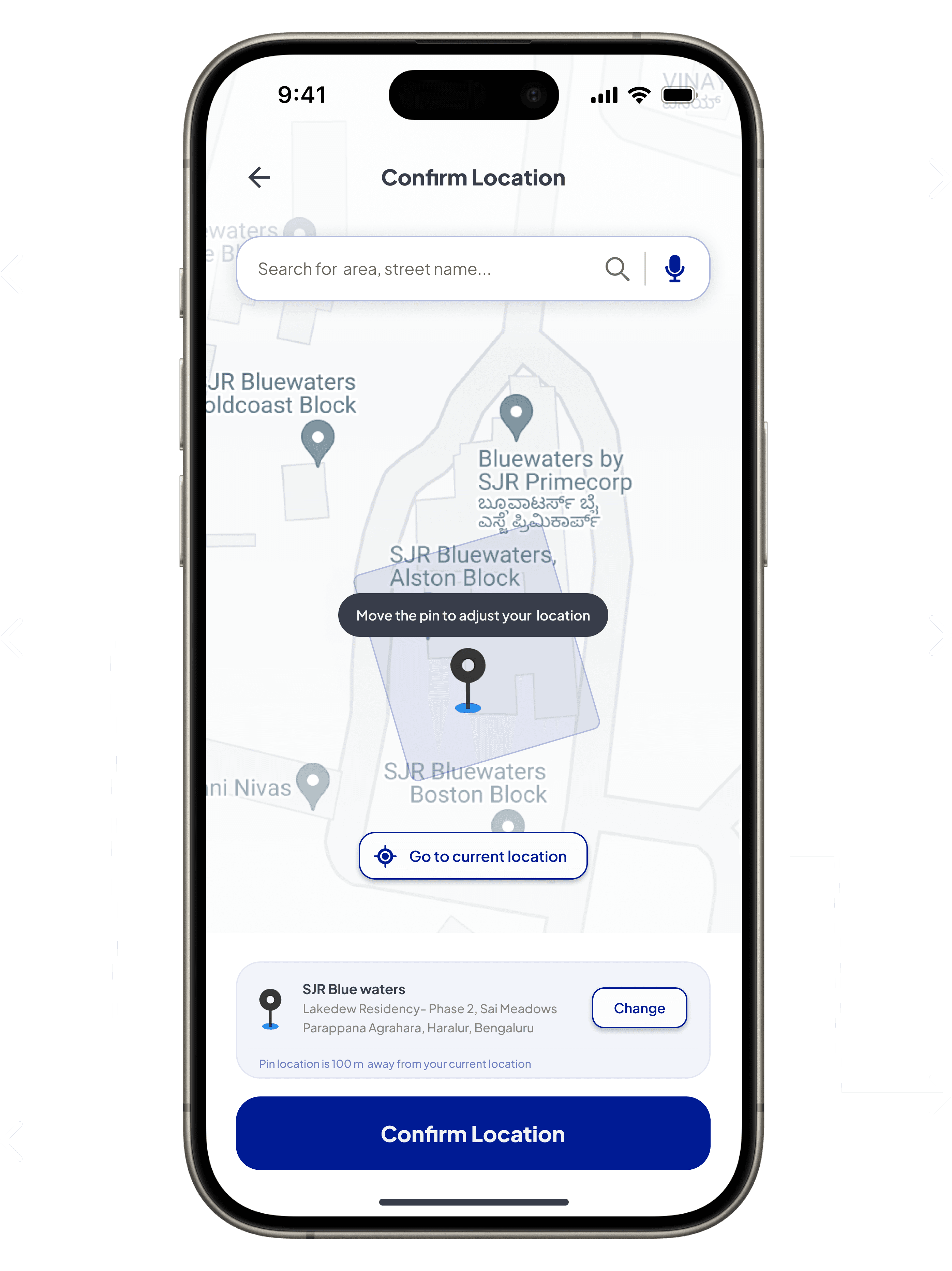

Enables users to manually adjust the pin to confirm a precise location, ensuring accuracy and personalization in location selection.

This call-to-action offers a quick option to auto-detect the user’s current location, placed within easy thumb

reach to reduce friction and streamline the process.

The heading “Confirm Location” clearly indicates the purpose of this screen, guiding users to finalize their location choice with confidence.

Allows users to search for a specific area or street name, giving them control to refine their location selection.

Displays selected location details with an option to change it, either by searching again or using the ‘Change’ button to ensure both transparency and flexibility for a wider audience.

Bold primary call-to-action prompts users to confirm the selected location, guiding them toward the next step.

1st Iteration

2nd & Final Iteration

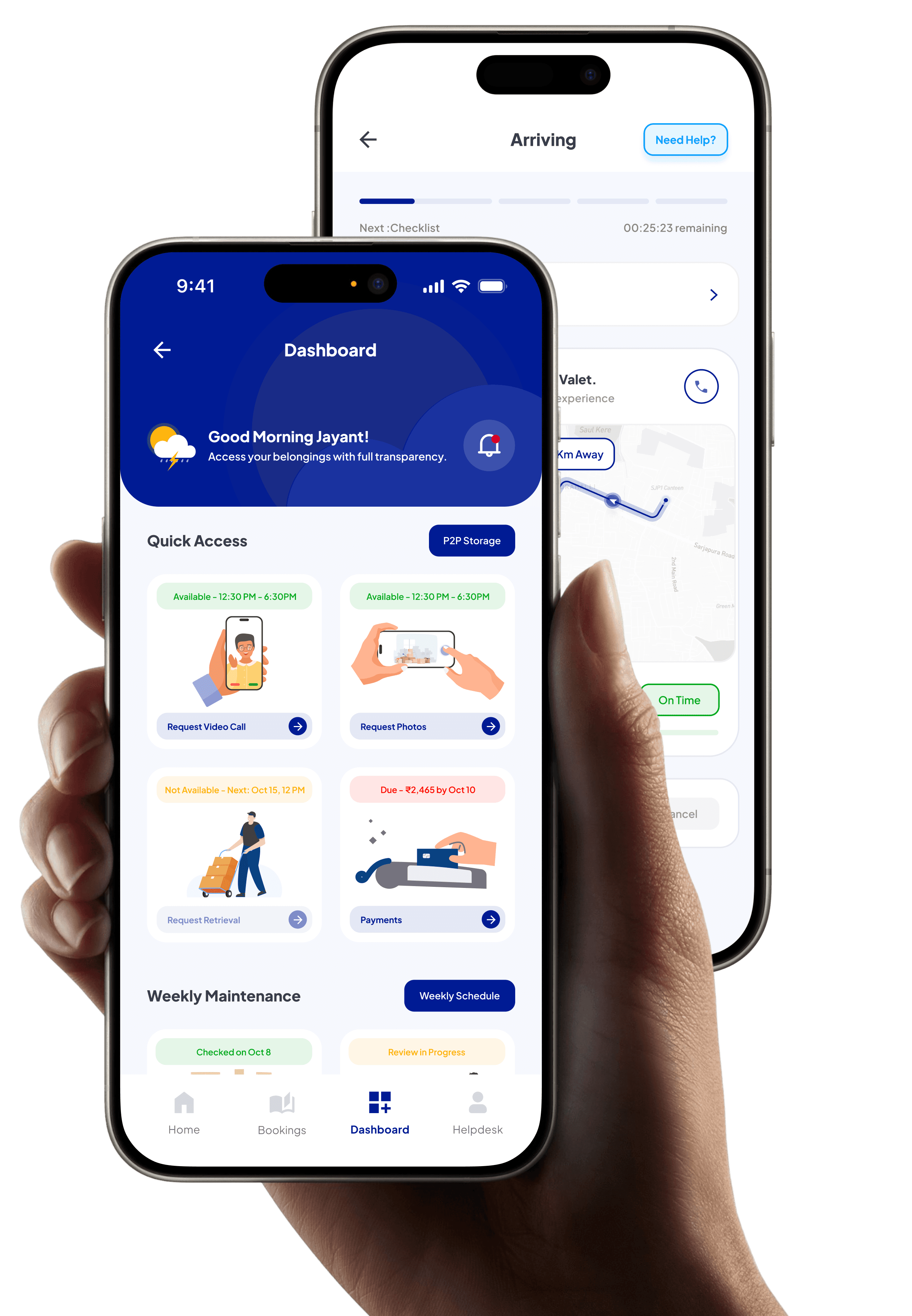

Let’s bring the solution-based design to life.

Welcome to Spacious! The name ‘Spacious’ embodies the core values of this solution—providing ample room for users’ storage needs while ensuring flexibility, security, and convenience in urban environments. From the initial layout to the final design, each iteration focused on improving clarity, functionality, and user experience, based on design exploration.

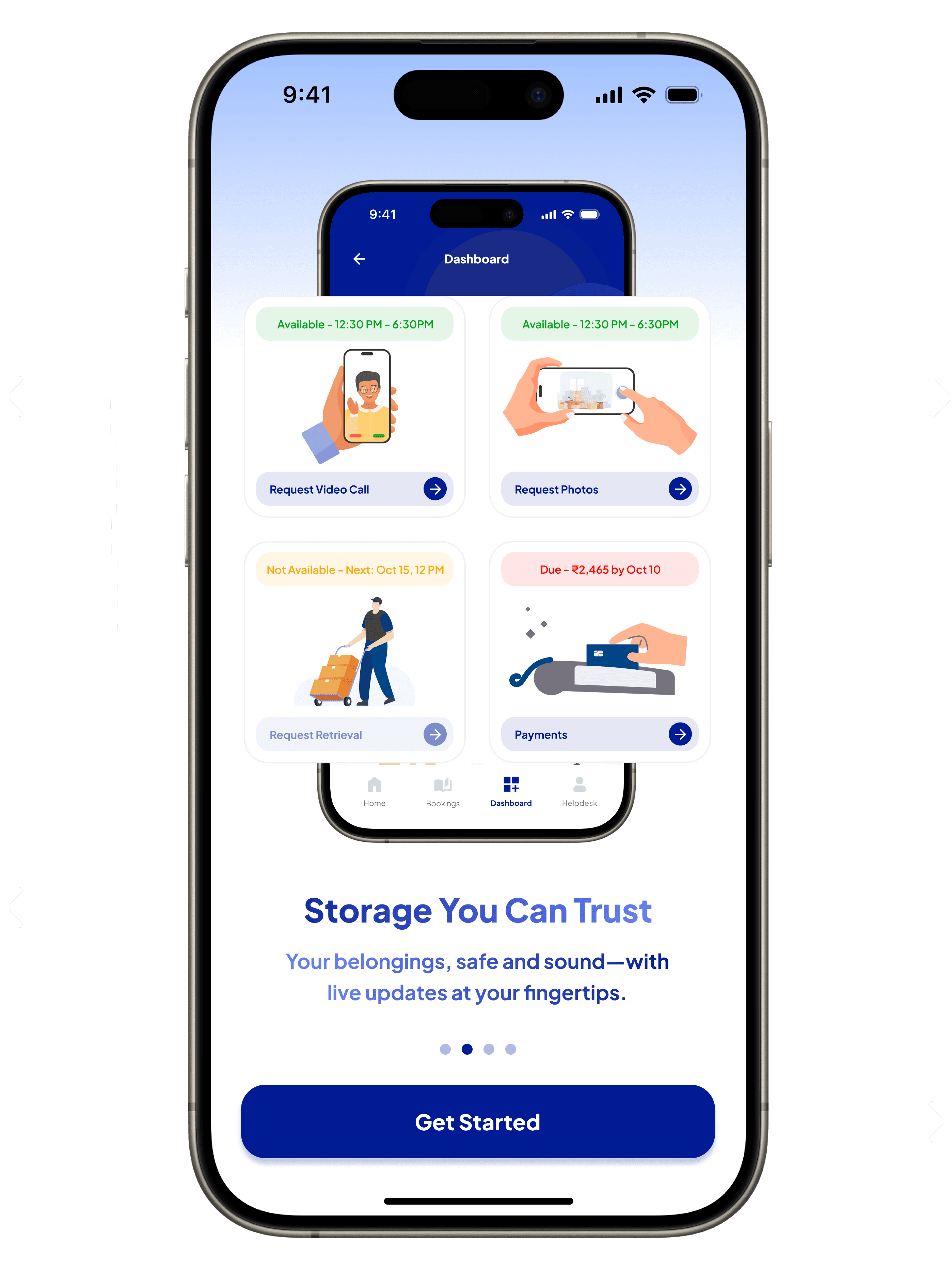

Onboarding User

1st Iteration

Positioned centrally to highlight key features, providing an immediate overview and clarity.

5th & Final Iteration

The bold blue primary call-to-action is centrally positioned with a more rounded radius, making it instantly visible and encouraging users to start interacting with the app immediately.

Slider dots signal a swipeable interface, encouraging interaction while maintaining focus on safety and live updates.

Changed text to enhance reassurance, align with the app’s core message, and emphasize live updates and ease of use, maintaining a balanced hierarchy with bold typography and a lighter tone.

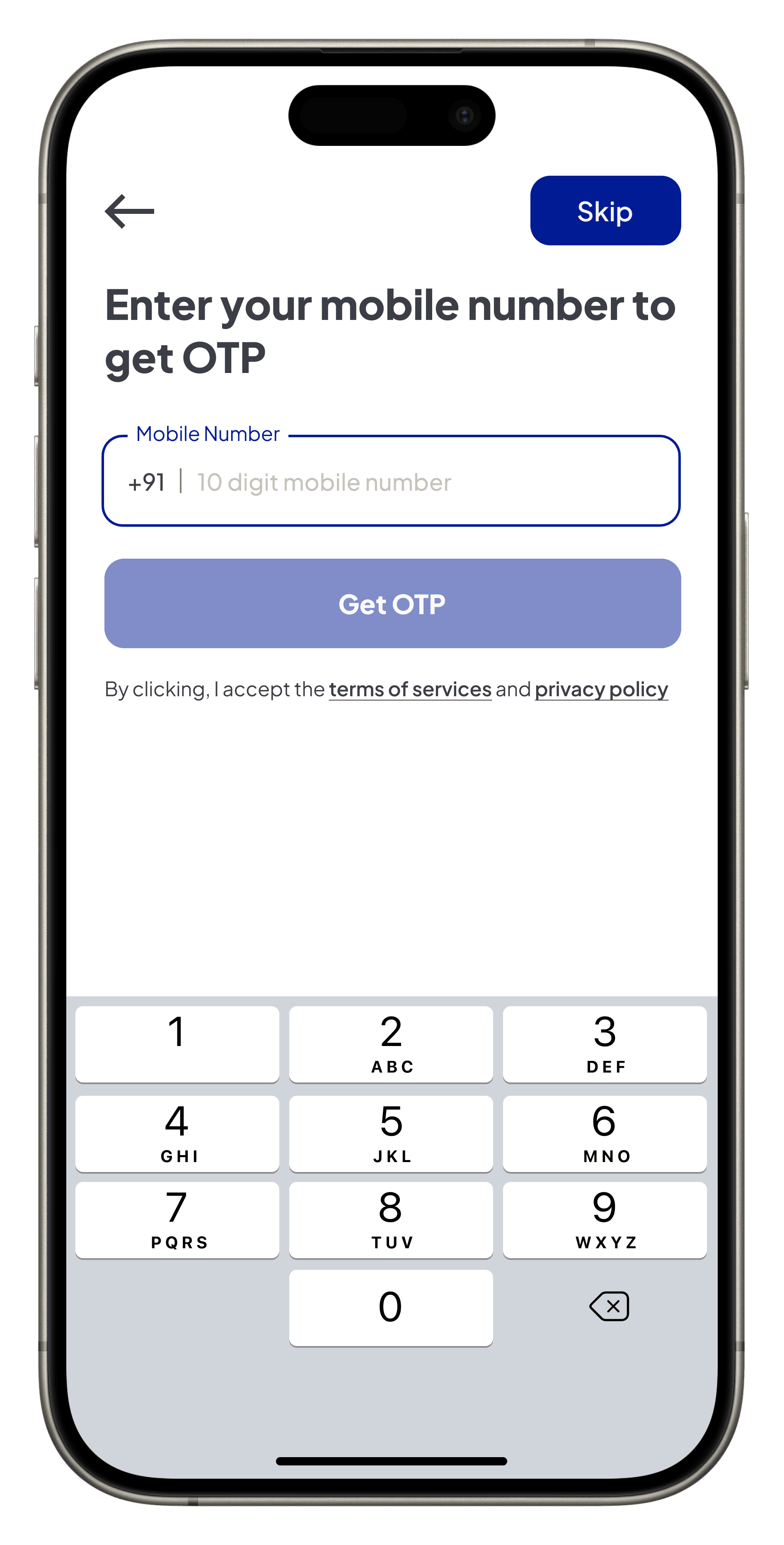

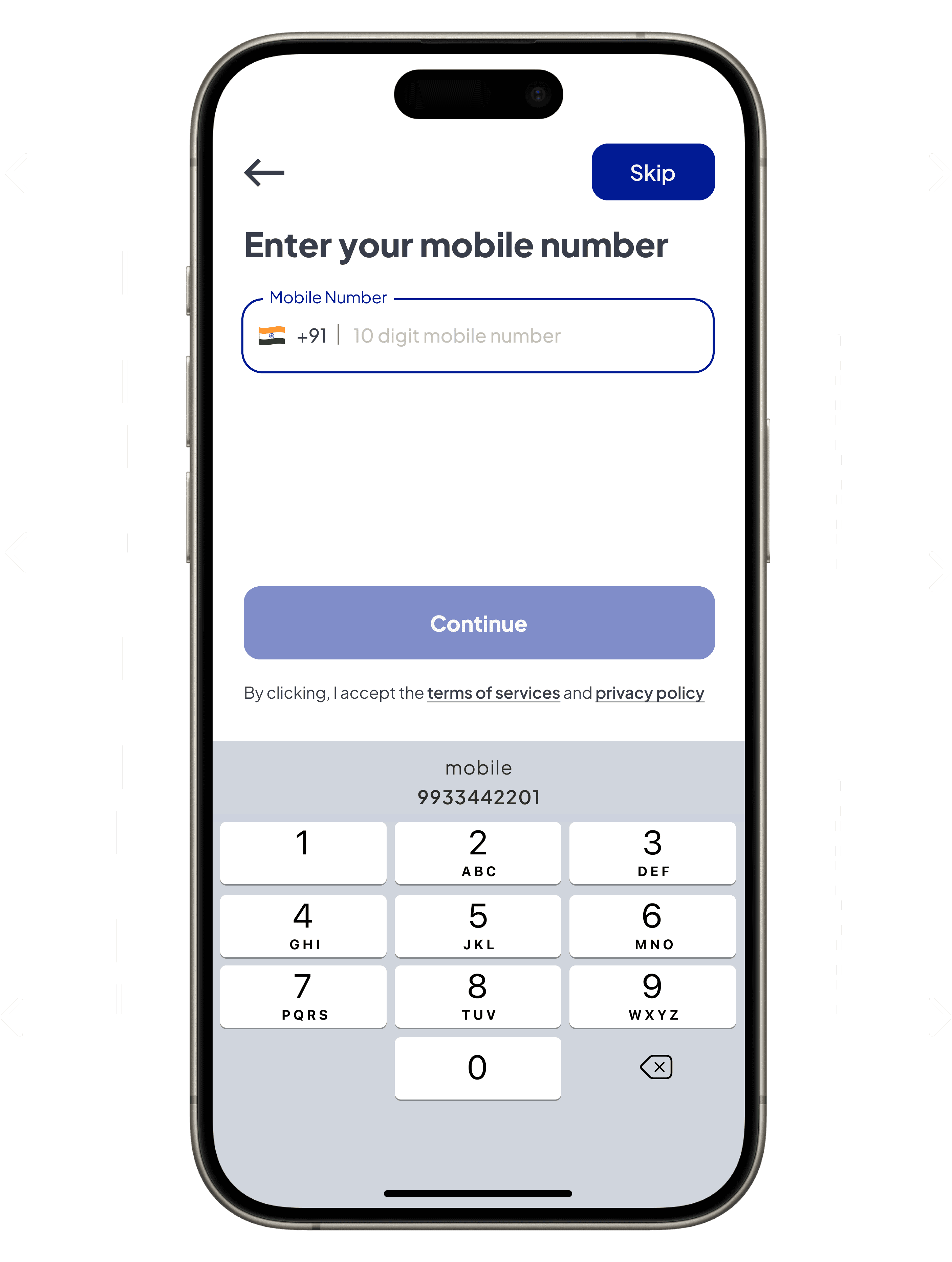

User Access

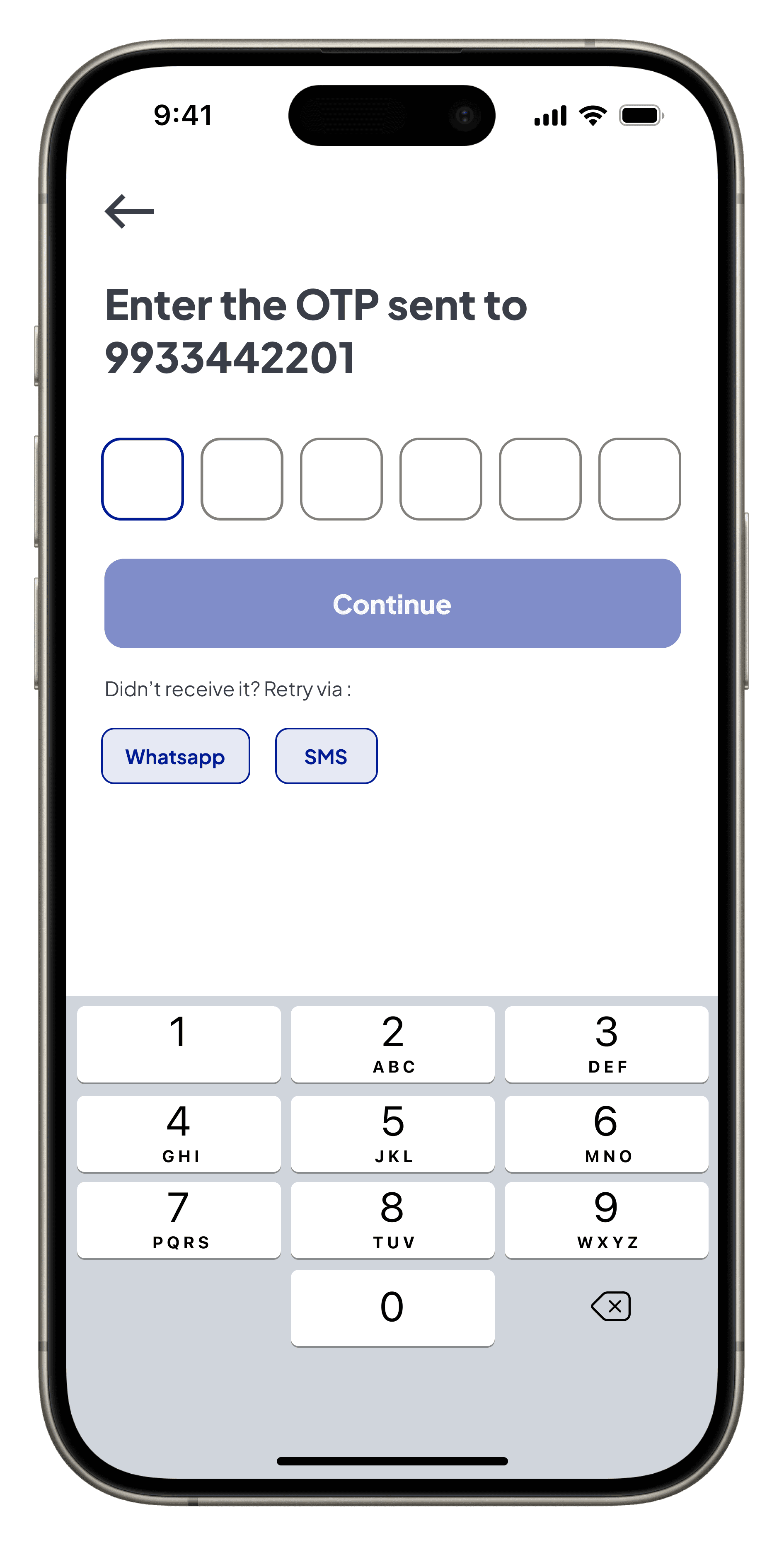

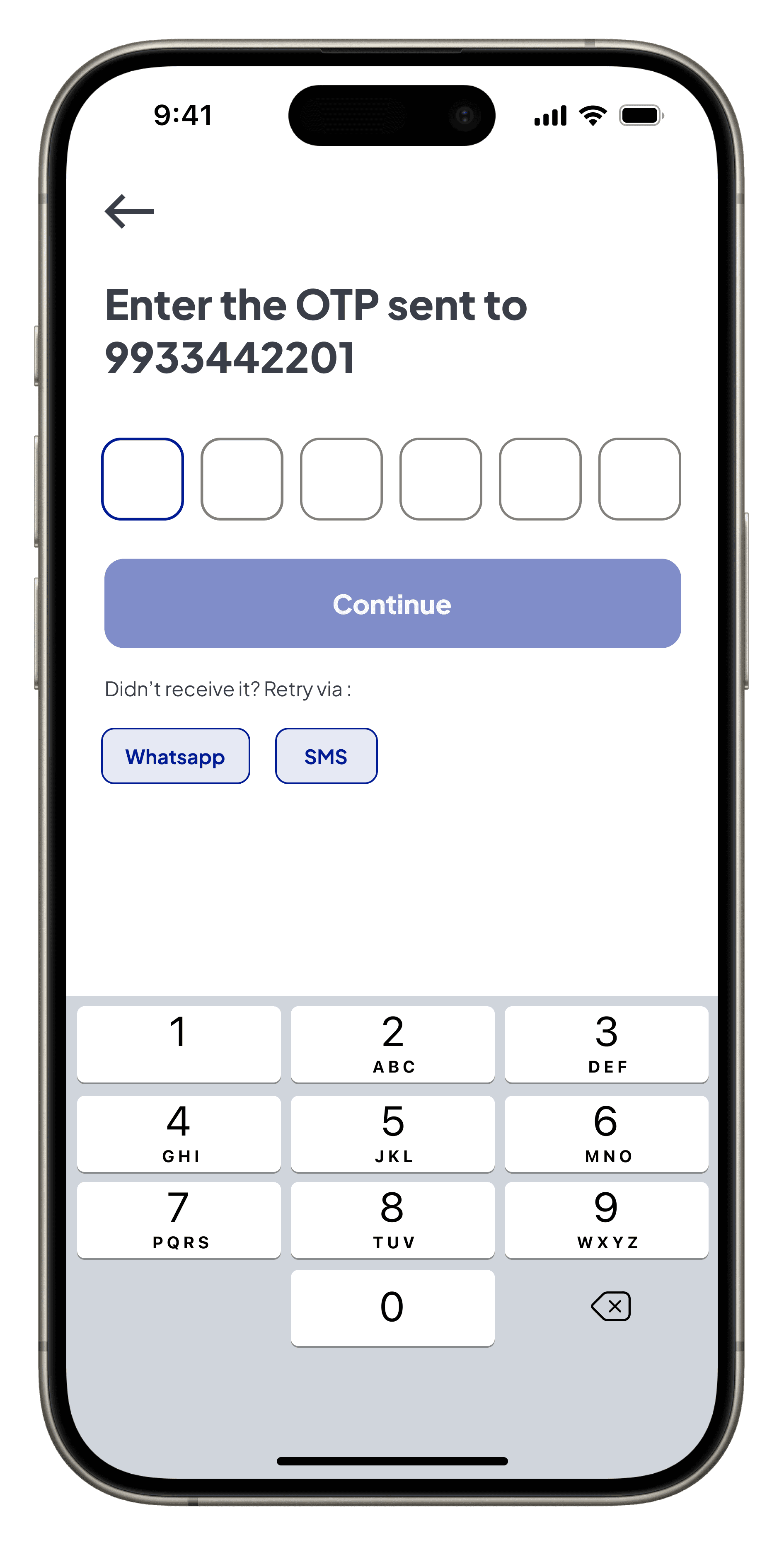

Back call-to-action to provide easy navigation to maintain continuity.

Changed “Enter your mobile number to get OTP” to “Enter your mobile number” for a more concise and focused screen, simplifying the initial step for users.

Changed “Get OTP” to “Continue” to reduce cognitive load and create a more universal action, maintaining interface consistency.

Skip allows users to bypass login and explore the app first.

A pre-selected country code (+91) and a flag icon enhance clarity and reduce potential errors during entry.

Pre-filled phone number replaces manual entry, reducing friction and speeding up the process for accurate format entry.

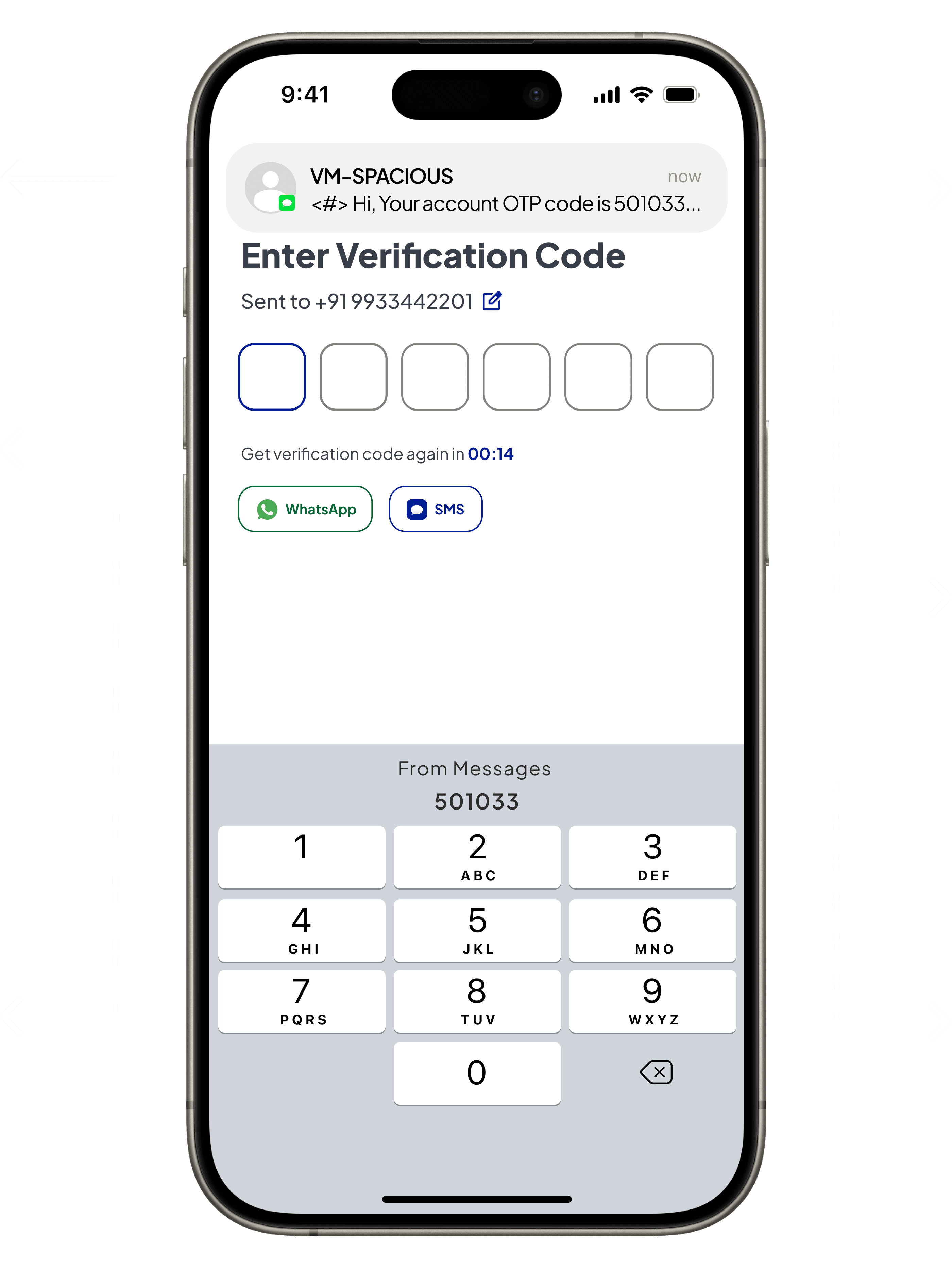

Changed from “Enter the OTP” to “Enter Verification Code” for a more concise and focused screen.

Countdown to make users aware of when the next OTP can be requested.

Retry Options via WhatsApp & SMS with redesigned icons provide a better user experience and alternative channels for receiving the OTP.

System-generated OTP msg provides instant visibility, allowing users to quickly review and enter the code.

Enabled editable phone number field to correct errors, enhancing flexibility and user control.

From manual entry to auto-generated OTP by removing the Continue button, reducing friction and cognitive load, speeding up the verification process.

1st Iteration

3rd & Final Iteration

With possible solutions - Information architecture

The following mind map visually represents the app’s structure, breaking down each feature and flow derived from the possible solutions.

Now, let's validate the real problem.

To understand the scope of the problem and how it affects users across different demographics and expectations, results from surveys conducted across various age groups and residents in different tiers reveal the true picture -

42%

Tier 1 Cities

Location Distribution

Summary

With a high concentration (42%) residing in Tier 1, followed by 28% in Tier 2, and a lower concentration (16%) in Tier 3 cities.

Key Insights

1. Tier 1 cities have a higher demand for paid storage services due to a more individualistic lifestyle, less reliance on neighbors, and limited family support. Residents are more likely to turn to professionals for storage solutions.

2. Tier 2 and Tier 3 cities show lower demand for professional storage services. The stronger social ties, reliance on neighbors, and extended family support allow residents in these areas to manage temporary storage needs informally.

40%

25-34 Years

Age Distribution

Summary

The need for temporary storage spans all age groups, with a high concentration (40%) in the 25-34 age demographic.

Key Insights

1. Young Professionals (25-34 years) are the primary users of temporary storage solutions, as they are more likely to move frequently for career opportunities, work remotely, or live in rented apartments.

2. Older age groups (35+) may require storage services less frequently as they are more likely to be settled in permanent homes and rely on longer-term storage solutions or informal family arrangements.

50%

Safety & Security

Summary

Only 20% of respondents had prior experience with storage facilities, but they prioritize security (50%) when choosing storage options.

Key Insights

First-time users may be cautious and prioritize security features before trusting storage providers, expecting high levels of safety assurance.

Key Insights

First-time users may be cautious and prioritize security features before trusting storage providers, expecting high levels of safety assurance.

54%

Price & Transparency

Summary

Cost is a significant consideration, with users valuing flexible budgeting options (54%). Transparent pricing and information are crucial.

Key Insights

Users are highly cost-conscious, seeking short-term, flexible storage solutions with clear and upfront pricing to avoid hidden fees.

15%

Climate Control

Summary

There is a growing importance for climate control (15%), indicating a need for solutions catering to sensitive items.

Key Insights

Growing demand for climate-controlled storage, particularly in Tier 1 cities, driven by sensitive items and valuable items.

< Spacious >

Simplifying Storage

Looks solid, right? Let’s break down how I got here.

But before we dive into the details, here’s a quick overview.

My Role & Collaborators

I facilitated the research, collaborated with design mentees to uncover key user insights, and independently crafted the design strategies and solutions based on our findings. My responsibilities included overseeing user research, analyzing user needs, and translating insights into actionable design strategies and solutions.

Is this a Real Problem?

Managing belongings during temporary transitions—whether due to frequent relocations, remote work, home renovations, extended travel, or other life changes—continues to be a challenge. Traditional storage solutions in india are often too rigid, requiring long-term contracts and high costs, and they lack transparency in terms of pricing and service availability.

Did i faced this real problem? Yes!

I personally experienced this issue when I had to keep paying rent on an apartment I wasn’t using just to store valuable belongings. While working remotely, I didn’t need these items, but they were too important to part with. Traditional storage options were far from ideal—most required long-term commitments like three- or six-month contracts, hefty deposits, and high costs. On top of that, many solutions were web-only with no convenient mobile apps for quick management. This led me to wonder—was my experience unique, or were others facing similar struggles? To break out of my own assumptions, I decided to dig deeper and validate this issue through broader research, understanding the pain points faced by others.

Market & data checks out - But what do users truly need?

While market and data highlighted some obvious gaps, user interviews revealed even deeper frustrations with traditional storage models. Throughout these open-ended discussions, participants not only shared their pain points but also began to explore alternative solutions they wished existed—solutions that could better address their needs for affordability, flexibility, and trust.

User Need

Affordability

Convenience

Flexibility

Security

Community Trust

Tech Accessibility

Pain Point

User Experience

High costs of traditional storage

Lack of nearby storage options

Long-term storage contracts are restrictive

Concerns over belongings’ safety

Lack of trust in larger cities

Limited mobile-friendly storage applications

“Storage facilities charge too much, especially for short-term needs,” shared a young professional.

“For home renovations, I need something close by, but all the storage options are too far away,” said a homeowner.

“As someone who travels for work, I need a flexible solution without a long-term contract,” mentioned a frequent traveler.

“I’m worried about how safe my things will be in a traditional unit,” said a retiree concerned about theft and damage.

“In my hometown, I knew my neighbors, but here in the city, finding someone trustworthy is much harder,” shared another user.

“Most storage services are web-based. I need something quick and accessible on my phone,” said a tech-savvy user.

Problem validated, Let’s explore possible solutions

It’s clear that users need affordable and flexible storage options that also provide security and convenience. From the 40% of users struggling with the high cost of traditional storage to the 54% seeking short-term, flexible solutions, the pain points are evident: affordability, accessibility in urban areas, and a lack of trust in available options. Addressing these needs, several solutions emerged through solo brainstorming and the use of a priority matrix to evaluate and prioritize the most viable ideas.

Flexibility & Cost-Effectiveness

User Need:

Users in Tier 1 cities are looking for flexible, affordable storage options with a sense of community and trust.

Possible Features:

Hybrid Storage Model: Combines peer-to-peer storage for cost savings with traditional warehouse storage for secure, short-term needs.

Cost Savings for Smaller Items: Peer-to-peer storage allows users to store fewer items at a lower cost, while fostering community connections.

Tiered Pricing Models: Offers flexible pricing based on storage size and duration, ensuring users pay only for what they need.

Trust-Building Features: Includes video calls and photo requests between users and hosts to verify trust and ensure transparency.

Convenience & Tech Accessibility

User Need:

Users want seamless access to storage options with an app that reduces friction and offers smooth onboarding.

Possible Features:

Mobile-First Platform: A mobile app for booking, tracking, and managing storage with ease.

Smooth Onboarding: A frictionless setup process that allows users to quickly understand the app’s features and begin using the service.

Feature Awareness: Built-in onboarding flows with tooltips to educate users about key features like AR measurement, real-time tracking, and seamless payments.

AR & Measurement Tools: Helps users accurately measure their items to ensure optimal space usage and cost savings.

Community Engagement & Transparency

User Need:

Users need a transparent system that enables informed decision-making, while also feeling a sense of trust.

Possible Features:

Transparency of Information: Provides clear details about storage costs, host reviews, and available space to help users make informed choices.

Community Interaction Tools: Introduces user ratings, feedback options, and the ability to communicate with hosts for added transparency.

Localized Recommendations: Suggests peer-to-peer storage options based on user location, fostering community-driven solutions.

Trust-Building Activities: Offers social proof through host ratings, past user experiences, and real-time interaction features to enhance trust.

Security & Trust

User Need:

Security and trust are critical, especially in peer-to-peer storage environments, where users need assurance of safety.

Feature Benefits:

Real-Time Monitoring: Offers live updates on the security status of stored items, providing users with peace of mind.

Enhanced Security Features: Includes host background checks, insurance options, CCTV, and biometric access for secure environments.

Host Verification & Reviews: Implements host verification along with community-driven ratings and reviews to build trust within the peer-to-peer model.

Transparent Safety Measures: Clearly outlines security protocols, and host reviews to provide full visibility into safety.